Short Sale Buying Advice

Purchasing foreclosures or REO properties presents difficulties for many investors. Public notice of a foreclosure auction is often sent to any parties interested in buying the property. Still, time and information are sometimes insufficient to undertake thorough due diligence. Surprises abound in foreclosed homes.

It’s common to see other (often savvy) buyers at the foreclosure auction willing to spend more than you are for the best homes if they know they can make a good deal later. However, with a short sale, you may typically arrange for a closing date that gives you more time to obtain financing, and you only need 10% of the purchase price in cash upfront and must secure a loan for the balance within 30 days. A judicial foreclosure can be complicated by a borrower’s right to redeem, but you can avoid this with a short sale.

It can be challenging to obtain property details for REOs, and lenders or their agents may be uncooperative when questions are raised about the property’s condition or an inspection is requested. Despite the common belief that banks will accept virtually any offer on REOs, the properties typically sell for close to their total market value once appropriate discounts are applied for their condition and the urgency with which they must be sold.

Look for homes whose owners have fallen behind on their debt service payments and negotiate a purchase price with them before they are forced to give up the property and suffer a hit to their credit rating. These occurrences increased as borrowers increasingly relied on high-leverage financing, in which they took out loans equivalent to or greater than the property’s purchase price. The cumulative debt of some borrowers who took out second loans was more significant than the property’s value.

They may rush through a few short-sale transactions if they have a lot of troubled loans on their books. In our experience, however, some lenders with a small number of overdue loans are more amenable to a short sale proposal from a buyer because they like to minimize their losses and avoid the possibility of government intervention or unfavorable publicity. Short-sale lenders are notoriously tight-lipped about the process.

The Mortgage Forgiveness Act of 2007 is one recent legislation that has dramatically aided property owners who wish to negotiate a short sale. In the past, homeowners had to report canceled or forgiven mortgage debt as income when filing their tax returns. Any loan used to acquire or construct a principal dwelling (as opposed to a second home or investment property) is now free from ordinary income taxation under the new law. Equally acceptable is the use of a refinancing loan for the same goals. The borrower must file Form 982, and the lender must file Form 1099-C with the IRS upon debt cancellation. This statute is now set to expire on January 1, 2010. However, it could be renewed. Before agreeing to any short sale, you should consult a tax expert.

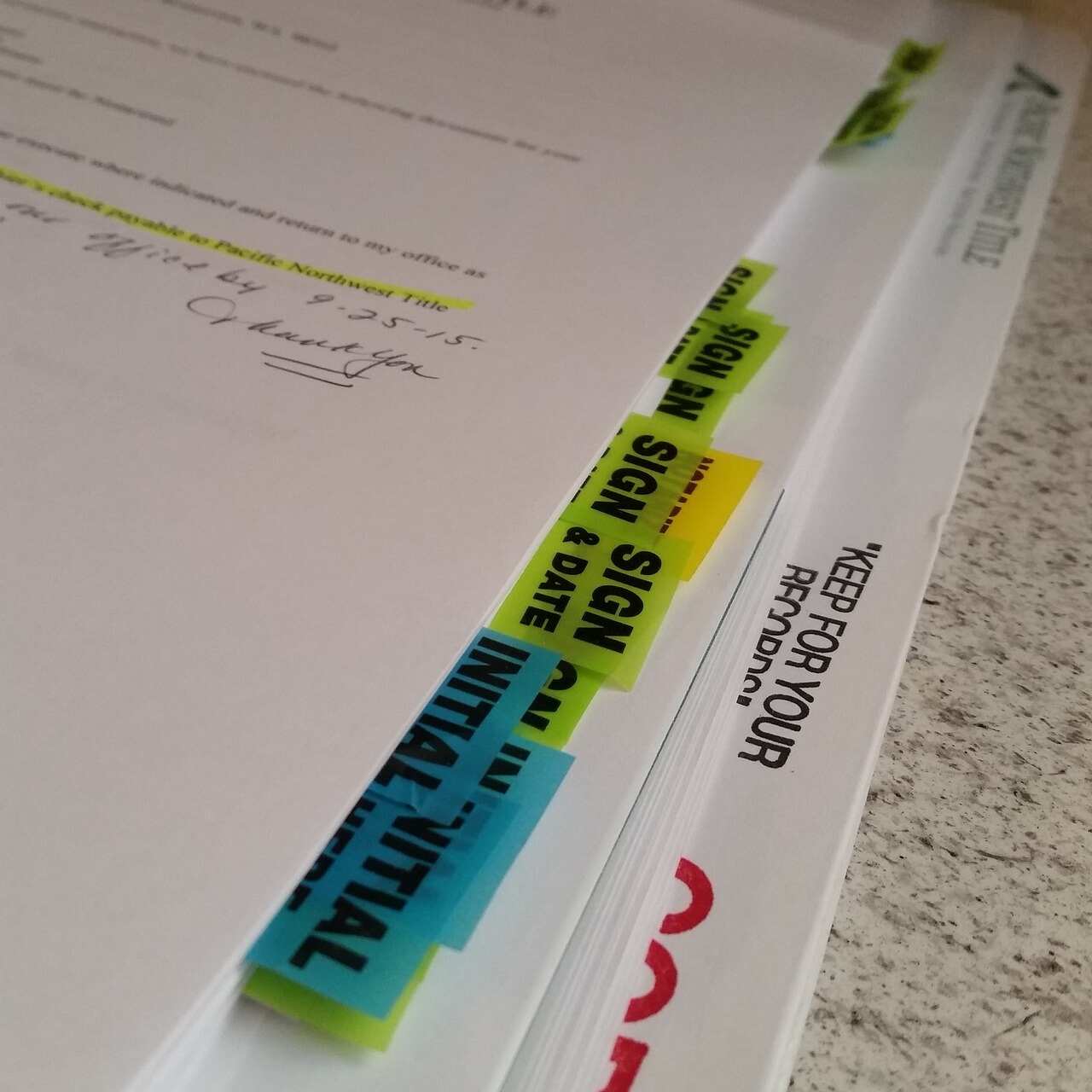

A lender short sale package should include the following details:

A letter of financial difficulty or other documentation demonstrating the borrower’s inability to maintain current mortgage payments.

Tax returns and W-2 forms for the borrower.

Details on the property’s current state, cost estimates, and repair proposals from licensed professionals.

Your offer price and the property’s estimated value.

Where there is a gap between the loan balance and the property’s value, the lender will want to make certain market circumstances are favorable. They plan to get a Broker’s Price Opinion (BPO) for the house. They will use this number as a starting point for negotiations with you and aim to get as near to the BPO as feasible.

The one thing all short sales have in common is the time and effort needed to contact the lender and find out if they are willing to accept an offer that is lower than the outstanding loan total. Each financial institution has its own unique structure for the people and departments responsible for troubled or defaulted loans. While some lenders use automated phone systems that can be beneficial and get you in touch with the proper people quickly, others are aptly named “voice mail jail.” Just explain that you need to speak to the person in charge of loss mitigation or foreclosures, and the live operator should know just who to put you in touch with. Your last resort is contacting customer service and requesting to talk with someone authorized to conduct sales on preforeclosure properties. Get the name of the borrower, the name of the property, and the loan number (if you have it).

Most lenders are now far more willing to work with the present borrower if possible, making these transactions unlikely and likely to take at least 30 to 90 days (or even longer). We recommend short sales only under special conditions and when you have direct access to a lender’s decision-maker willing to negotiate and engage in a quick sale. There are probably more efficient alternatives for the real estate investor seeking for a single property to find and buy investment real estate.

To move fast while engaging in short sales, you must have access to cash on hand and loan approval in advance. Short-sale lenders will expect full payment in cash and will not provide any form of financing. Short-sale lenders will be picky about giving loans for investment homes the borrower won’t occupy. It helps to have good credit and an established banking relationship to acquire short sales.

Discover My Secret Sources For Short Sale Houses…

Read also: https://booklysis.com/category/real-estate/